Entity Classification

Services

Choosing the right tax classification for your business is a crucial step for maximizing tax efficiency and maintaining compliance in the U.S. For LLCs and other eligible entities, IRS Form 8832 allows you to elect how your business is classified for federal tax purposes. At iFiler, we provide expert guidance and full-service assistance with Form 8832 filing, ensuring your business is correctly classified and compliant with IRS regulations.

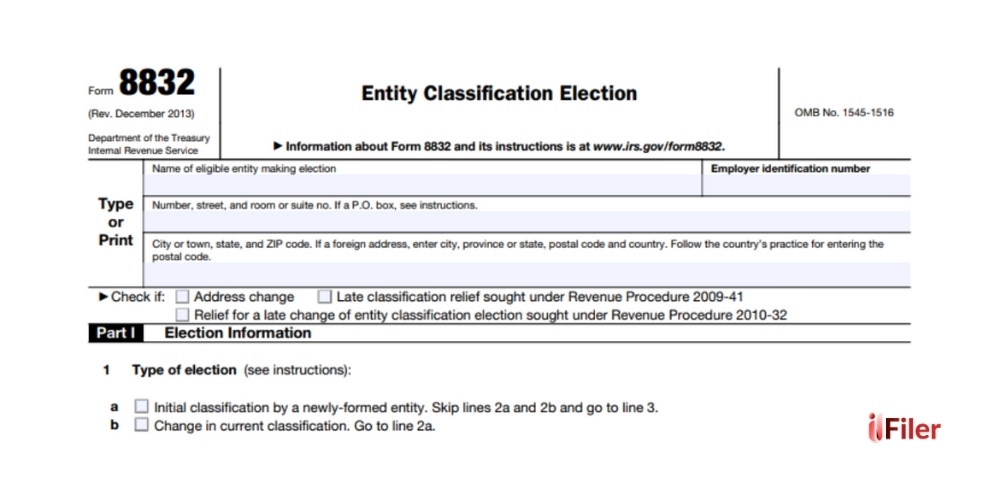

Form 8832 – Entity Classification Services

What is Form 8832?

Form 8832 – Entity Classification Election is an IRS form that allows eligible entities to select how they will be taxed. By default, a single-member LLC is considered a disregarded entity, and a multi-member LLC is treated as a partnership. However, filing Form 8832 gives you the flexibility to elect alternative classifications such as:

-

Corporation – C-Corp classification for separate taxation

-

S Corporation – Eligible if specific IRS requirements are met

-

Partnership – For multi-member LLCs choosing partnership taxation

Proper classification impacts your tax obligations, liability, and future financial planning, making it essential to choose wisely.

Why File Form 8832?

Filing Form 8832 offers several advantages:

-

Tax Flexibility – Choose a structure that minimizes your tax liability

-

Investment Readiness – Corporations (C-Corp or S-Corp) are often preferred by investors

-

Compliance – Ensures your IRS records match your intended tax treatment

-

Business Strategy – Supports long-term growth, profit distribution, and planning

-

International Operations – Helps foreign owners navigate U.S. tax requirements

Without the correct election, your LLC may be taxed under default rules, which might not align with your financial strategy.

Who Needs Form 8832?

-

Single-member LLCs seeking corporate taxation

-

Multi-member LLCs electing corporation classification

-

Businesses planning to attract U.S. venture capital

-

International business owners needing U.S. tax-compliant entity classification

-

Companies with multiple income streams that benefit from specific tax treatments

How iFiler Can Help

Filing Form 8832 can be confusing due to IRS requirements and deadlines. iFiler provides:

1. Expert Guidance

-

Evaluate your business structure and goals

-

Recommend the optimal entity classification for tax and business objectives

2. Form Preparation & Filing

-

Complete and submit Form 8832 accurately to the IRS

-

Ensure all supporting documentation meets IRS standards

3. Deadline Management

-

Filing is time-sensitive; iFiler ensures elections are made within the required timeframe to avoid back taxes or penalties

4. Post-Filing Support

-

Confirmation of IRS acceptance

-

Guidance on integrating the classification into your accounting, banking, and compliance workflows

Documents Required

To file Form 8832, you typically need:

-

LLC Formation Documents (Articles of Organization)

-

EIN (Employer Identification Number)

-

Member or shareholder information

-

Previous tax returns (if applicable)

-

Business details for classification and election purposes

iFiler ensures all documentation is accurate and IRS-ready.

Benefits of Using iFiler

-

Professional IRS filing – Avoid errors that can trigger audits or delays

-

Tailored advice – Choose the classification that best fits your business goals

-

Time-saving – We handle the entire filing process for you

-

Non-resident support – Ideal for international business owners

-

Integration with other services – Works seamlessly with EIN, ITIN, banking, and tax filing services

Service Need?

Get Started with iFiler

Ensure your business remains compliant, credible, and legally recognized. With iFiler’s Annual Compliance Filing Services, you can focus on growth and expansion while we take care of your regulatory obligations.

Free Consultation

Start Smart with a Free Consultation. Get expert advice on U.S. or U.K. company formation, compliance, and e-commerce setup — with no cost, no pressure, and no commitment. Book your free session today.